3 Dividend Stocks I'm holding for the long term & Why

Although I'm only at around 260 followers on Twitter, the one question I've been asked the most is, "What are the best dividend stocks to invest in?". Although I couldn't tell you the "best", I can certainly tell you three stocks I'm incredibly excited about and plan to hold for years to come.

1: Iron Mountain ($IRM)

Iron Mountain is a business that owns data centres that stores, manages or destroys data for other businesses. Below are reasons why I'm invested in IRM:

- Founded in 1951. This shows that it's a strong, established business with a track record of data management.

- 2,000+ locations to serve their clients who need data storage solutions.

- Data storage and management is an industry that's still in its infancy. With technology booming, company's like IRM will thrive.

- 98% tenancy rate for 30+ years. The thing about Data is that once a company has found a place to store it (IRM's data-centres), they'd rather not move it.

- Strong 5.71% Dividend Yield.

- Consistent Net income and revenues over the past few years.

- Strong revenue attributed directly to operating activities.

2: Franklin Resources ($BEN)

Money makes money, but only a handful of investment firms make money as long as Franklin has. Franklin Resources is a global investment management company that serves retail, institutional and high net-worth clients in various jurisdictions. Here's what I love about Franklin Resources:

- They are incentivized to manage money safely, which is why I'm secure with my investment in them.

- They've been around since 1947 - Which once again signifies an established brand.

- FR has Consistently increased their dividend and is a dividend aristocrat.

- They currently manage $1.5T on investor money.

- They recently appointed a new Vice President and Chairman of the Asia-Pacific region, Dr. Meng, who will help drive Franklin Templeton’s (owner of Franklin Resources) Asia Pacific and global growth strategy in partnership with the firm’s existing leadership.

Medical Properties Trust ($MPW)

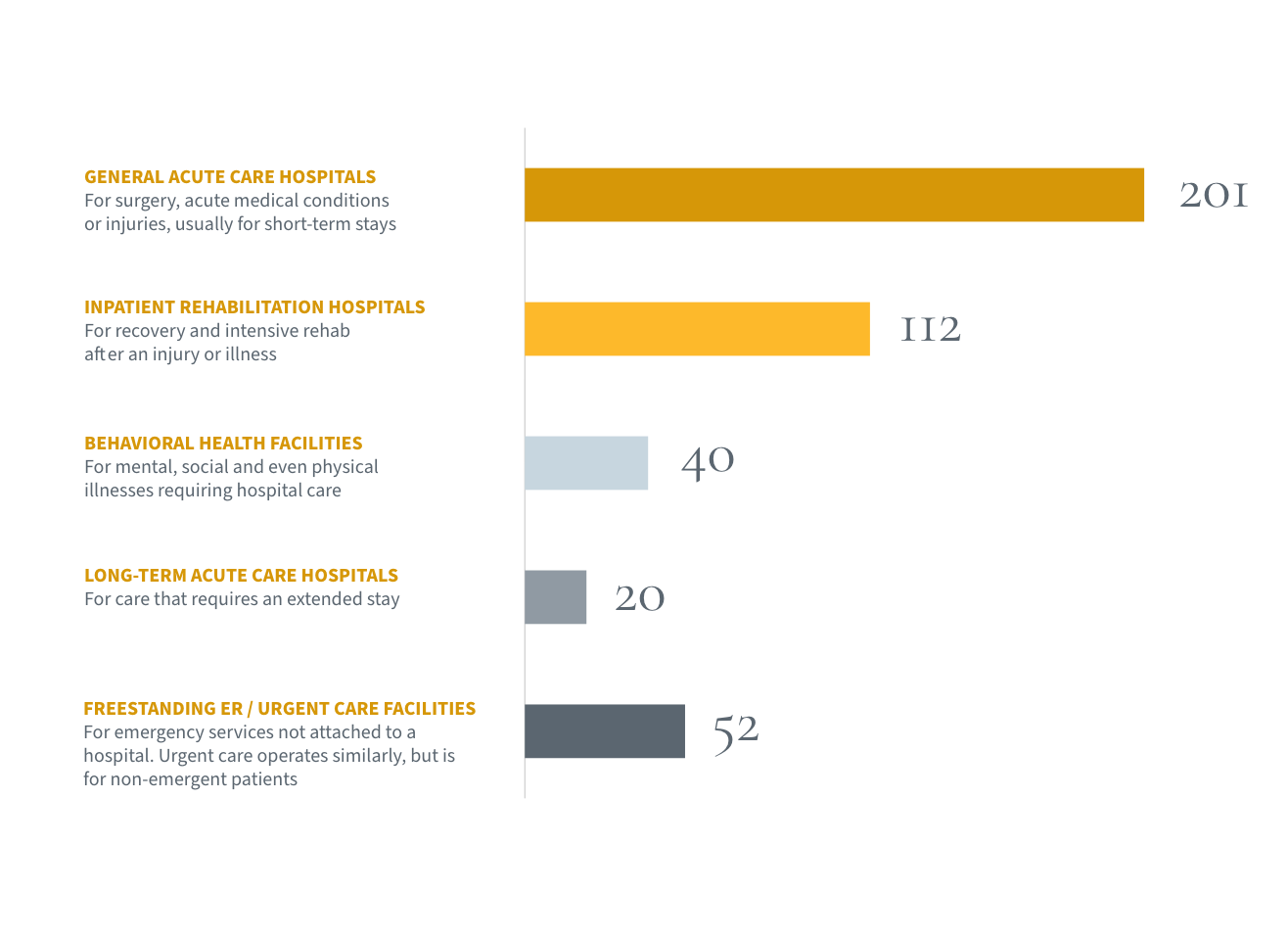

Medical Properties Trust is what's known as a Real Estate Investment Trust, or to my fellow dividend lovers, a REIT. There are currently tons of REITs out there that people are crazy about, but none have sparked joy in my mind the way this company has recently, and here's why:

- MPW is focused on investing in and owning hospitals globally.

- They're the second-largest owners of hospital beds in the United States, which allows them to provide equipment in addition to selling/leasing hospitals.

- Formed in 2003 and have consistently grown assets, revenues and global portfolio diversification.

- Growing dividend for the past 4+ years.

- Consistently buying back shares which increase shareholder's value.

Why I invest in these companies

My investment thesis is this: Invest in companies who have a strong focus on serving their target market on a big scale, as well as ensuring they are capital efficient. I do my best to stay away from companies that are losing money, even if they have high yields.